‘The One Thing He Brought to the Job as an Advantage Is Unraveling’

In electing an avowed billionaire businessman as president, a deal-maker devoted to creating more American jobs, Americans could have believed that they had at least one basically sound principle to pursue with Trump.

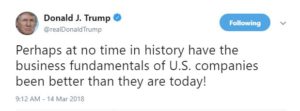

Whatever else Trump did that might disrupt, act out through provocative tweet or even serve to flip off American tradition, custom and values, he would be rock solid on looking after job creation.

How are we doing?

A year in, we’re on the verge of a huge trade war with China and others though administration officials either were taking pains yesterday to say otherwise or saying, yes, a trade war is warranted, the vaunted gains in stock market value were teetering, new job creation is starting to dwindle and lots of companies are still laying off people. The claimed economic gains spawned by a corporate tax cut have delivered benefits to the wealthy class, but the gains elsewhere are now openly being questioned as the rising prices for imported goods through tariff policies will eat up any personal tax gains.

Meanwhile, housing starts are down, job training lags and the president is choosing older manufacturing and mining goals instead of preparing for a future where the U.S. needs to compete in the arenas of AI, artificial intelligence, and non-fossil fuel energy sources.

This president is impulsive, has no specific agenda and tends to go back to moves that serve his most loyal base by acting first and then perhaps later actually making a big tack work as policy. These characteristics are reflected in wildly cowboy-like actions to expand tariffs on Chinese imports by another $100 billion.

That these Trump-style, disruptive actions may lead to unintended results in the stock market, among American farmers and manufacturers who depend on imported steel and aluminum and for consumer prices, well, that strikes me as something of a different order. If Mr. Art of the Deal is as much a savvy businessman as he thinks he is, he ought to be able to predict what happens when he fiddles with the levers of the U.S. economy.

So, my first gripe of the day is: Making unilateral policy when you don’t know where the actions will lead.

My second gripe of the day is: Where are the Republican congressional leaders? The silence, once again, speaks volumes. Where is the oversight over all this?

Of course, behind these gripes is a general complaint that this president refuses to heed economic learning just as he rejects science in general. And he refuses to listen to advisers who simply are unable to persuade him of the likely outcomes of actions.

On top of all of this, it is difficult to understand that Trump actually believes that China will bend just because he tells them to kneel to his word. After all, this is the same China that holds the largest portions of U.S. debt, that is a formidable rival for control of the South Asia sea lanes and that clearly is the key to reaching some kind of peaceful agreement with the loony North Korean leader over de-nuclearization efforts for the Korean peninsula.

Why does Trump believe that faced with higher consumer prices on all sides, in China, America, Europe and the rest of Asia, that China will reform its ways? What they do in Beijing has been working pretty well for them. But even more, why does Trump believe suddenly that China will limit its responses to trade issues alone, that it will not reach into a more complete diplomatic, financial and strategically military response as well?

The more I see of Trump as businessman, the less I am impressed. I realize that Trump enterprises have gone south multiple times and he has been sued oodles of times for non-payment of contracts. I guess, without sufficient evidence, that he has failed to share his income taxes because he wants to keep some aspect of the tax returns extremely private either because the returns show he has cheated or that he is not worth what he says he is. I realize that Trump’s negotiating style is just as much at issue as the policy he seeks to win.

The new job figures this week show about 104,000 jobs, about half the amount of job creation as had been expected, offsetting the hyped addition of 300,000 in January. In fact, the Labor Department now is saying that January figure must be adjusted downward. The entire Trump economic effort is tied to job creation, particularly in mining, steel and heavy-metal manufacturing.

Data show that, as this column predicted, companies are choosing to spend more money on debt retirement, stock buybacks and technology investments than on job creation. Wages have remained stagnant and despite the hype over tax cuts, the wage gap between workers and bosses has grown wider and any improvements have served the specific Rust Belt areas where Trump won over broader support for job creation in new technologies.

Whatever gains were achieved have given way to nervousness and market uncertainty. It seems an economic truism that in uncertain times, markets lose value.

The very fact that the White House has been given the assignment to calm nerves should say a lot about how reckless the tariff approach is proving to be.

Bottom line: The one thing Trump may have brought to the job as an advantage is itself unraveling as he sows disruption around with trade partners.

Maybe the president just needs a bigger America First hat.