HUD’s Carson Wants to Make It Easier for Banks, Insurers and Landlords to Redline Minorities

The Trump administration is trying to make it easier for banks, landlords and insurance companies to discriminate against minority homeowners and tenants.

Anna Maria Farías, an assistant secretary at HUD, is asking for comments on possible revisions that could “add clarity” and “reduce uncertainty” on a HUD rule based on a legal theory the Obama administration and its predecessors used to prove discrimination cases.

The theory, “disparate impact analysis,” measures discrimination, such as African-Americans paying higher interest rates on loans, without having to prove an intent to discriminate.

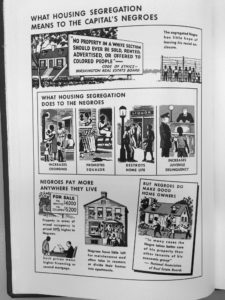

More than 50 years after passage of the Fair Housing Act of 1968, signed just seven days after the assassination of Dr. Martin Luther King, African-American homeownership rates are almost the same as the 1960s. Neighborhoods are more segregated now than they were in 1918.

ACTION BOX/What You Can Do About It

Comment online by Aug. 20 or mail comments to Regulations Division, Office of General Counsel, Department of Housing and Urban Development, 451 7th St. SW, Room 10276, Washington, DC 20410-0500. Comments should use the identification number Docket No. FR-6111-A-01.

Call Anna Maria Farías, the assistant secretary for Fair Housing and Equal Opportunity, at 202-708-4252.

The National Fair Housing Alliance can be reached at 202-898-1661 or [email protected].

One major case where attorneys used disparate impact analysis to prove discrimination was about a law adopted by St. Bernard Parish, La., after Hurricane Katrina. The parish, where 93% of the homeowners were white, prohibited homeowners from renting to anyone except a “blood relative” unless they had permits.

A 2013 HUD rule meant to help fight long-standing segregation laid out how to analyze disparate impact claims under the Fair Housing Act. A 2015 Supreme Court case, Texas Department of Housing v. Inclusive Communities Project, upheld using the theory in Fair Housing Act cases.

Republican lawmakers have urged HUD Secretary Ben Carson to review the rule. Seventeen of the 18 House members who signed the letter have received $55,333 in campaign contributions so far for the 2018 election from the political action committee of the Property Casualty Insurers Association of America which has sued HUD over the rule.

Their letter regurgitated some of the points made in court filings by insurance industry attorney Paul Hancock, who was representing the American Insurance Association in another lawsuit against HUD. Four of the letter signers have received a total of $13,000 so far for the 2018 election from the political action committee of the America Insurance Association.

Carson has criticized efforts to undo discrimination with disparate impact.

“These government-engineered attempts to legislate racial equality create consequences that often make matters worse,” Carson wrote in The Washington Times.

The Trump administration claims it needs to consider revising the 2013 rule because of the Supreme Court case, but Stacy Seicshnaydre, a law school professor at Tulane University, said nothing in the Supreme Court ruling undermines the HUD rule.

“It’s not technically true,” Seicshnaydre said of the Trump administration claims.

Craig Gurian, the executive director of the Anti-Discrimination Center in New York, said HUD could try to make it more difficult for plaintiffs in fair housing cases to prove discrimination.

“They can make it much more difficult to utilize the rule,” Gurian said.