Part-time Pay, Adjusted for Inflation, Fell in 2021

The number of Americans earning less than $15,000 a year fell significantly in 2021 as a growing number of states and localities increased minimum pay standards for millions of part-time workers, new federal wage data shows.

One in four Americans with paid work made less than $15,000 in 2021. DCReport refers to these people as part-timers because working full-time for all 52 weeks at the federal minimum wage earns gross pay of $15,080.

After considering inflation, their average pay fell by $275 for the year. That’s the equivalent of working one week for no pay.

The average 2021 pay of this group was just $6,186. Assuming all of them earned the minimum wage, on average, they worked two days a week.

The number of part-time workers plummeted from nearly 46 million people in 2020 to 41.4 million in 2021. That’s almost a 10% drop in just one year. The decline means that about 4.5 million workers moved up to gross pay of more than $15,000.

Offsetting that is some not-so-good news.

For part-timers, average pay rose by less than $15—for the entire year, not that anyone would notice such a trivial increase.

Real Pay Declined

After considering inflation, their average pay fell by $275 for the year. That’s the equivalent of working one week for no pay.

These figures contrast with the disturbing trends DCReport documented in Part 1 and Part 2 of our series showing how the thin and rich slice of employees paid $1 million or more are gobbling up most of the pay increases in America. DCReport calls these people the Executive Class.

The share of all pay going to workers making $1 million or more in today’s money has grown since 1991 from 2% to 6.7%.

Full-time workers making up to $250,000—that’s 97% of all full-timers—got an average raise of $1,600 in 2021. The average Executive Class pay hike was $840,500.

That means for each $1 in added pay going to each person among the vast majority of full-time workers, those in the Executive Class employees got $500 in added pay.

Awful as that disparity is, it’s better than 2020, the last year of the Trump administration. The Executive Class got 82% of all 2020 pay increases in America, as DCReport revealed a year ago.

I’ve analyzed this Social Security wage data, which adds up every W-2 wage statement to the penny, every year for the last quarter century.

Not Considered News

No major news organization has reported any of the data in our current series or previous articles, even though the data comes straight from our government. Anyone with a spreadsheet could analyze it. That’s because journalists generally and accurately report what sources tell them without doing their own analysis of government reports. The reasons that the union movement ignores this data and the story it tells of the Executive Class gobbling up more and more of the wage pie remains a mystery.

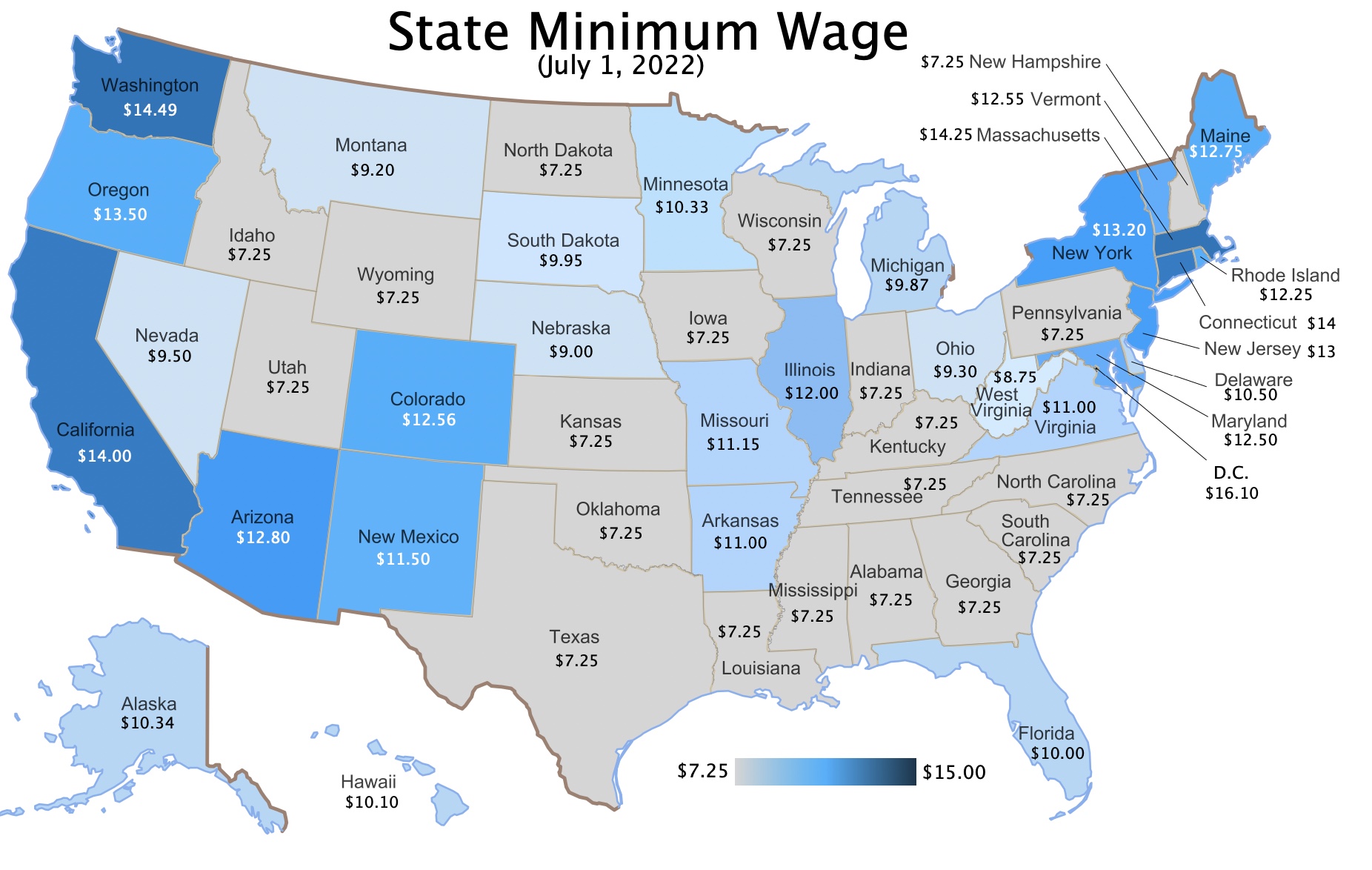

The federal minimum wage has been stuck at $7.25 an hour since 2009 under a law signed by President George W. Bush. Inflation has eroded the minimum wage. It’s now the equivalent of making just $5.16 an hour in 2009.

The minimum wage for restaurant and bar workers has been fixed at $2.13 an hour since 1993 under a law that President Bill Clinton signed. That’s just $1.02 per hour in today’s money. (The difference with the $7.25 minimum wage comes from tips, so waiters and bartenders only benefit from tips when they exceed more than five bucks an hour.)

President Joe Biden signed an Executive Order raising the minimum wage for employees to federal contractors to $15 an hour.

Many Republicans in both chambers of Congress oppose any minimum wage law. The Heritage Foundation, a marketing organization for right-wing oligarchs, insists that raising the minimum wage hurts workers.

The share of workers making less than $15,000 slowly ebbs over time when wages are adjusted for inflation. For example, $10,000 in 2003 was just about $15,000 in 2021, allowing comparison within the rigid income groupings used by Social Security.

In 2003, Social Security data shows, 28.1% of workers made less than $15,000 in 2021 money. In 2021 that share was down to 24.6% of workers.

If that rate of shrinkage rate continues, my calculations show that in the year 2148 no one will be making less than $15,000 in today’s money. Of course, as economist John Maynard Keynes famously observed, in the long run, we are all dead.