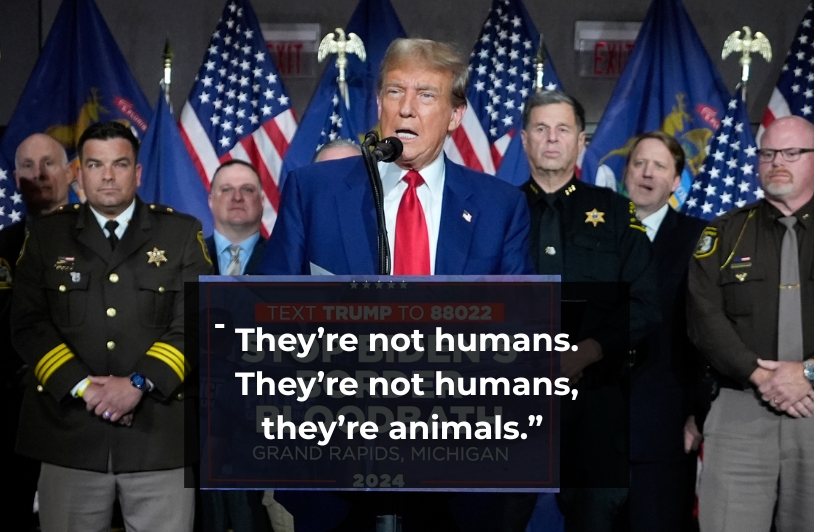

Trump’s Racism and Misogyny in Action

Team Trump Claims Whites Are the Real Victims of American Racism Donald Trump and his faithful are working hard to end what they view as anti-White racism. From... Read more.

All The Damage Trump’s Tariffs Are Doing

A Decade Ago Trump Went to Great Lengths to Evade U.S. Tariffs Just how could Donald trump’s so-called Liberation Day tariffs mess up the American and world... Read more.

I’m Not Leaving

Trump, As de Facto Dictator, Ramps Up Lawless Attacks On Critics Three Yale University professors steeped in the history and techniques of authoritarianism are leaving... Read more.

Trump’s Fictional World Built On Lies

The Unvarnished Ignorant Bully Was on Display for All to See The whole world has now seen the Trump I know. Watching his Oval Office attack on Ukraine President,... Read more.

Deadly Musk-Trump Administration Policy Starts

Without a new flu vaccine the Grim Reaper will be busy next winter More Americans will die next winter unless the Musk-Trump administration backs off an action it... Read more.

Ominous Move to Strip Americans of First Amendment Rights

Trump Demands Journalists Use Language He Wants or Face Punishment Donald Trump’s oft-stated hostility to journalism, and his dictatorial efforts to force journalists... Read more.

Trump Marches Towards Absolute Power and Control. I Told You So … Again

His Dictatorship Is Taking Shape Right in Front of Our Eyes Donald Trump just fired the chairman of the Joint Chiefs of Staff, who is Black, and will replace him... Read more.

Apparently We Are Willing to Give Up Our Freedom, Cowering to Trump … A Power-Mad Con Artist With No Soul

Are Democrats and the Masses Calmly Accepting This Fate Like Lambs Led to Slaughter? Right in front of our eyes, you’re seeing the destruction of the United... Read more.

A Democracy-Threatening Dereliction of Duty, but No Reason To Cancel Subscriptions

Don’t Harm Both the Great Work and the Solid Journalists Soldiering On That some Americans say that they are cancelling the Washington Post, LA Times, Detroit... Read more.

Trump & Co. Think We’re A Nation of Wimps

Osama bin Laden Would Love GOP Rants on Immigrants and Foreigners Nine years ago, I wrote a column about Republican candidates for president doing the work of the... Read more.